colorado electric vehicle tax incentive

Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page. Ad Visit the Official Chevy Site and Explore What the 2022 Chevrolet Colorado Has to Offer.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

1500 between 2021 to 2026.

. 2500 to buy or 1500 to lease. Colorado offers its green drivers the following state tax and sales tax incentives. What we really need is to remove the cap in order not.

For 2022 the amount of the tax credit to buy or lease an EV is. Local and Utility Incentives. The Xcel Energy rebates come as the value of Colorados electric vehicle tax incentive has shrunk.

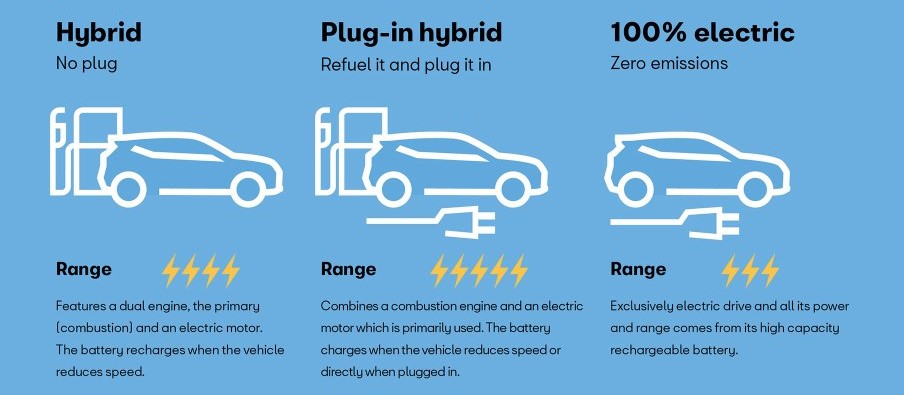

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. President Bidens EV tax credit builds on top of the existing federal EV incentive. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Light-duty EVs regular EV cars. From 1 January 2021 to 31 December 2023 owners who register fully electric cars and taxis will receive a rebate. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Household motor vehicle trips are one of the biggest drivers of transportation emissions in the country. How much can I save with the Colorado electric vehicle incentive. 2500 in state tax credits and up to 7500 in federal tax credits.

There is also a federal tax credit available up to 7500 depending on the cars battery capacity. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. UtilityPrivate Incentives Electric Vehicle EV Charging Station Incentive Holy Cross Energy HCE.

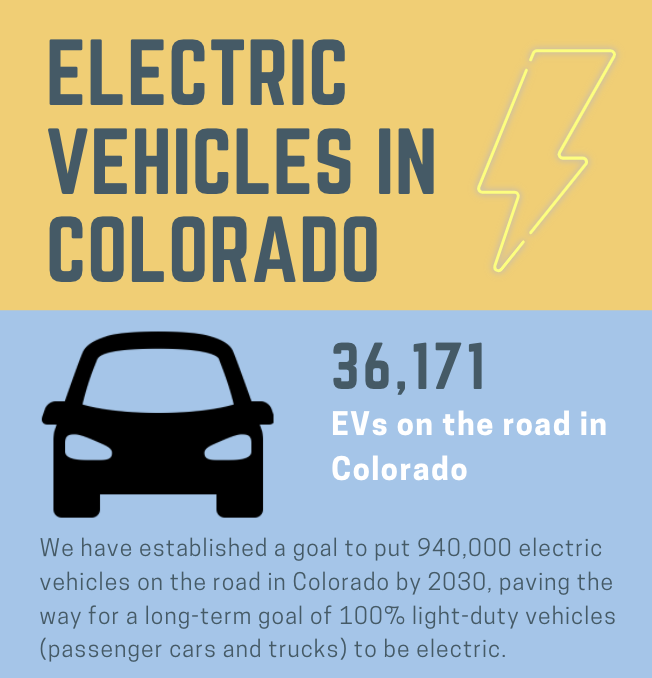

Qualified EVs titled and registered in Colorado are eligible for a tax credit. The Colorado Energy Office ReCharge Colorado program works to advance the adoption of electric vehicles EVs and installation of charging infrastructure across the state. Examples of electric vehicles include.

The original 5000 tax credit was one of the countys most generous when it went into effect. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

3500 to buy or 1750 to lease. Trucks are eligible for a higher incentive. Some dealers offer this at point of sale.

The credits decrease every few years from 2500 during January 2021 2023 to 2000 from 2023-2026. Low Emission Vehicle LEV Sales Tax Exemption. Tax credits are as follows for vehicles purchased between 2021 and 2026.

Contact the Colorado Department of Revenue at 3032387378. According to the US Department of Energy in 2017 nearly 60 of household motor vehicle trips were 6 miles or less and 75 were 10 miles or lessTrips of these lengths are very doable by bike for most Americans particularly if completed on an electric bike eBike. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the.

Colorados National Electric Vehicle Infrastructure NEVI Planning added 6142022. This scheme applies to individual and fleet vehicle owners such as taxi and car rental companies. Get information about state and federal Tax Credits and learn about how to apply these credits toward your future EV.

So weve got 5500 off a new EV purchase or lease and 3000 off of used. Qualified EVs titled and registered in Colorado are eligible for a tax credit. What is the Charge Ahead Colorado Program About.

Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. Electric Vehicles Solar and Energy Storage. In looking at 400 state and local incentives intended to encourage the adoption of plug-in electric vehicles since 2008 the 2018 NREL study found that for every 1000 of tax credits battery-electric vehicle sales improved 53 while similar rebates increased sales by 77.

The table below outlines the tax credits for qualifying vehicles. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. For Colorados 5000 tax credit that means the incentive likely.

Alternative Fuel Advanced Vehicle and Idle Reduction Technology Tax Credit. While Colorado does not have an electric vehicle rebate the state offers tax credits for the purchase or lease of an electric vehicle EV of up to 3500. For tax years January 1 2010 January 1.

Electric vehicles emit fewer greenhouse gases than gas-powered vehicles. 45 off the Additional Registration Fees ARF Capped at 20000. Park Chaffee Fremont Custer El Paso Pueblo Elbert Lincoln Crowley Kit Carson Cheyenne Kiowa.

Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs. Use the following as a starting place as you dig deeper into. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche.

It raised the incentive to 12000 per electric vehicle. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. In an effort to improve air quality and encourage deployment of electric vehicles across the state of Colorado the Colorado Energy Office CEO and Regional Air Quality Council RAQC have teamed up to offer grants for Level 2 and Level 3 charging stations through Charge Ahead ColoradoSince its inception in 2013 the.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. For more on federal tax incentives see the bottom of this section. Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends.

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. Colorado Energy Offices Recharge Colorado program works to advance the adoption of electric vehicles EVs and charging installations throughout. I think the current 7500 is fine.

Why buy an Electric Vehicle. UtilityPrivate Incentives Electric Vehicle EV Charging Station Rebate - San Isabel Electric Association SIEA. Colorado EV Incentives for Leases.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds. Electric Vehicle EV Tax Credit.

The True Cost Of Going Electric Gobankingrates

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

Joseph Biden Aims To Improve Us Ev Tax Credit Restore It For Tesla Gm Electric Cars Tesla Fuel Cost

Electric Vehicles In Colorado Report May 2021

How Do Electric Car Tax Credits Work Credit Karma

Tax Credits Drive Electric Northern Colorado

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Zero Emission Vehicle Tax Credits Colorado Energy Office

Global Electric Vehicle Charging Stations Market 2021 Business Overview And Forecas Electric Vehicle Charging Station Electric Vehicle Charging Electricity

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Electric Vehicle Charging Stations City Of Centennial

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives For Purchasing Or Leasing Electric Vehicles In Colorado

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

A Complete Guide To The Electric Vehicle Tax Credit

All About Electric Vehicles De Co Drive Electric Colorado

Electric Car Charging Stations In Community Associations Five Things To Consider The Ksn Blog