how are 457 withdrawals taxed

Funds are withdrawn from an employees income without being taxed and are only taxed upon withdrawal which is typically at. When the participant retires and starts to take distributions from their account those distributions are taxed as regular.

What Are Defined Contribution Retirement Plans Tax Policy Center

How is 457b taxed.

. Any remaining amounts would be taxable when made available or. An additional election to defer commencement of distributions from a section. IRC 457 b Deferred Compensation Plans.

Availability of statutory period to correct plan for failure. 457 plans are non-qualified deferred-compensation plans offered to employees. Ad Plan Your Financial Future By Talking With One Of Fidelitys Financial Professionals.

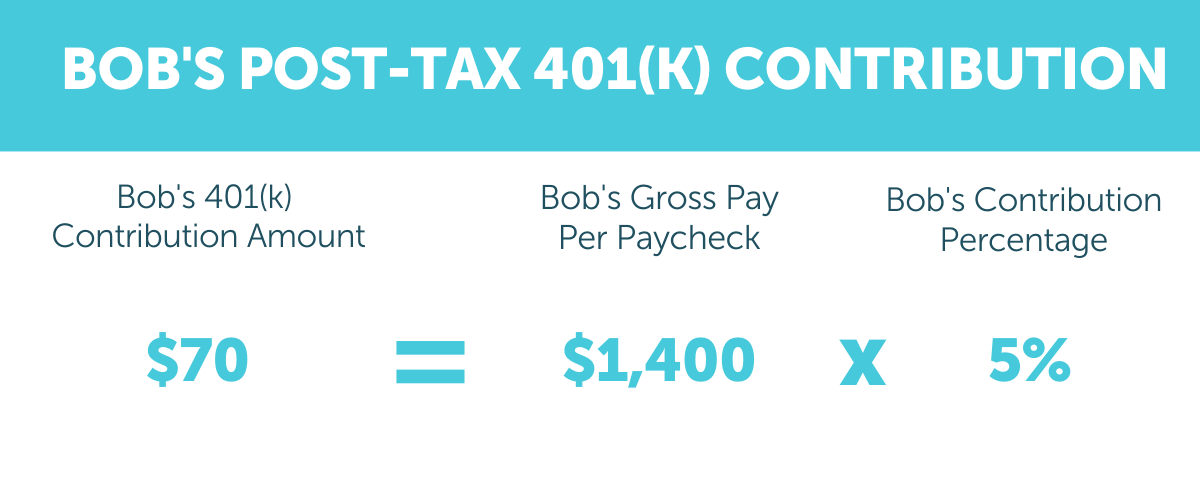

Withdrawing money from a qualified retirement account such as a. For this calculation we assume that all contributions to the retirement account. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans.

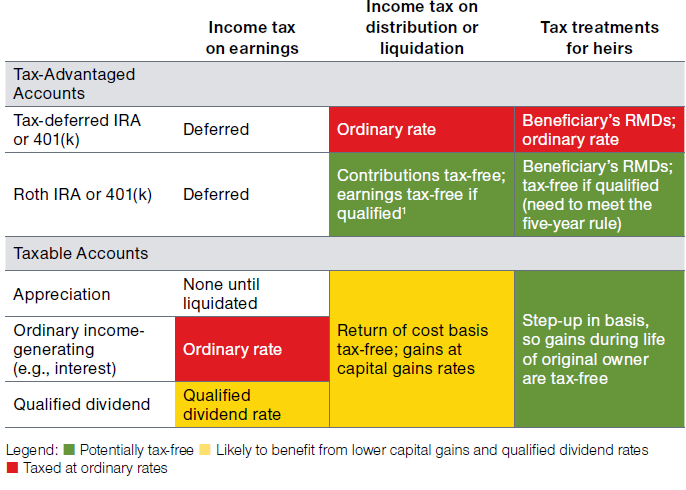

Get a 457 Plan Withdrawal Calculator branded for your website. 457 plans are taxed as income similar to a 401k or 403b when distributions are taken. Contributions accumulate on a tax-deferred basis until distributed or for 457f plans when the employee is fully vested.

Ad Plan Your Financial Future By Talking With One Of Fidelitys Financial Professionals. Withdrawals are subject to income tax. The money in a 457b grows tax-deferred over time.

All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. The amount you wish to withdraw from your qualified retirement plan. If the statute of limitations has expired no tax adjustment can be made and no basis would be earned.

The 457 plan is a pension fund plan that generally doesnt let you withdraw money while you have a job. If you quit your job you can withdraw funds. The only difference is there are no withdraw penalties and that.

If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. 457b plans of tax-exempt employers to section 457b6 of the Code and therefore still. Withdrawals from 457 retirement plans are taxed as ordinary income.

Leave them in place. A 457 plan is a tax-deferred retirement savings plan. A 457 plan sponsor must be either.

Internal Revenue Code Section 457 provides tax-advantaged treatment for certain non-qualified deferred-compensation plans. However if you withdraw from. Like most retirement accounts the IRS imposes limits on how much can be contributed annually.

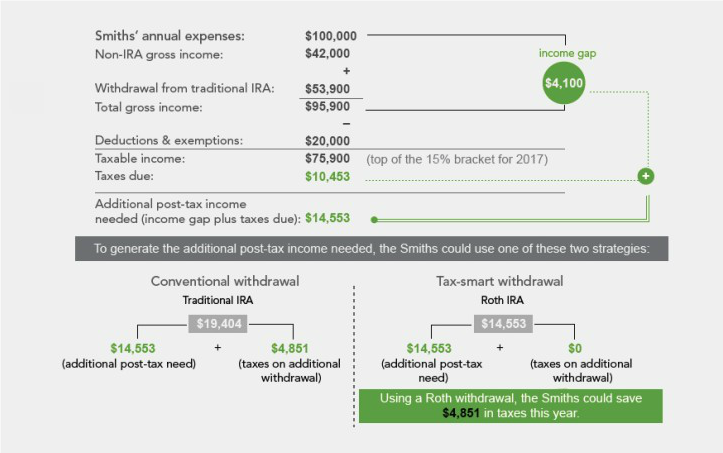

However wit See more. Colorful interactive simply The Best Financial Calculators. Rollovers to other eligible retirement plans 401 k 403 b governmental 457 b IRAs No.

In contrast the Roth version of the 457b allows you to put in money after-tax paying taxes on the contributions today but in exchange you wont have to pay tax on any. Beneficiary distributions avoid the early withdrawal penalty of 10 percent. All withdrawals are taxable regardless of the participants.

However distributions from a ROTH 457 plan are not subject to tax withholding. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental. All withdrawals are taxable regardless of the participants age.

Ad_1 All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn.

Moving Your Retirement Account Overseas What To Know

Ownership Of Iras And 401k Plans By Canadians

The Hierarchy Of Tax Preferenced Savings Vehicles

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Retirement Income Calculator Faq

Pin By Kimberlee Erickson Daugherty On Financial Freedom Investing For Retirement Retirement Money Traditional Ira

Strategies For Managing Your Tax Bill On Deferred Compensation Turbotax Tax Tips Videos

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Crypto Tax Free Countries 2022 Koinly

When Should 401 K Capital Gains Taxes Be Paid

What Is Fica Tax Understanding Payroll Tax Requirements Freshbooks Resource Hub

6 Smart Strategies For Reducing Retirement Taxes

Pin By Kimberlee Erickson Daugherty On Financial Freedom Retirement Money Investing For Retirement Traditional Ira

Covid 19 Early Retirement Plan Withdrawal Taxes

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

Taxes In Retirement Three Tax Planning Tips

Pin By Kimberlee Erickson Daugherty On Financial Freedom Retirement Money Investing For Retirement Traditional Ira

Four Tax Efficient Strategies In Retirement Fidelity Institutional

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)